Invest with us

Requirements for the project initiator

We expect the project initiator to demonstrate the following:

- Successful business experience

- Strong business reputation

- Competitive advantages

- Availability of a competent management team

- Availability and willingness to invest own capital (“skin in the game”)

Requirements for the project

Our pipeline projects are featured with the following:

- Value-added industries

- Alignment with the Fund’s investment philosophy

- IRR of 15% or higher

- Employment opportunities for the local workforce

- Integrating new technologies

- Export orientation and/or import substitution

Why invest with UzDIF?

Investing with UzDIF can bring the following advantages:

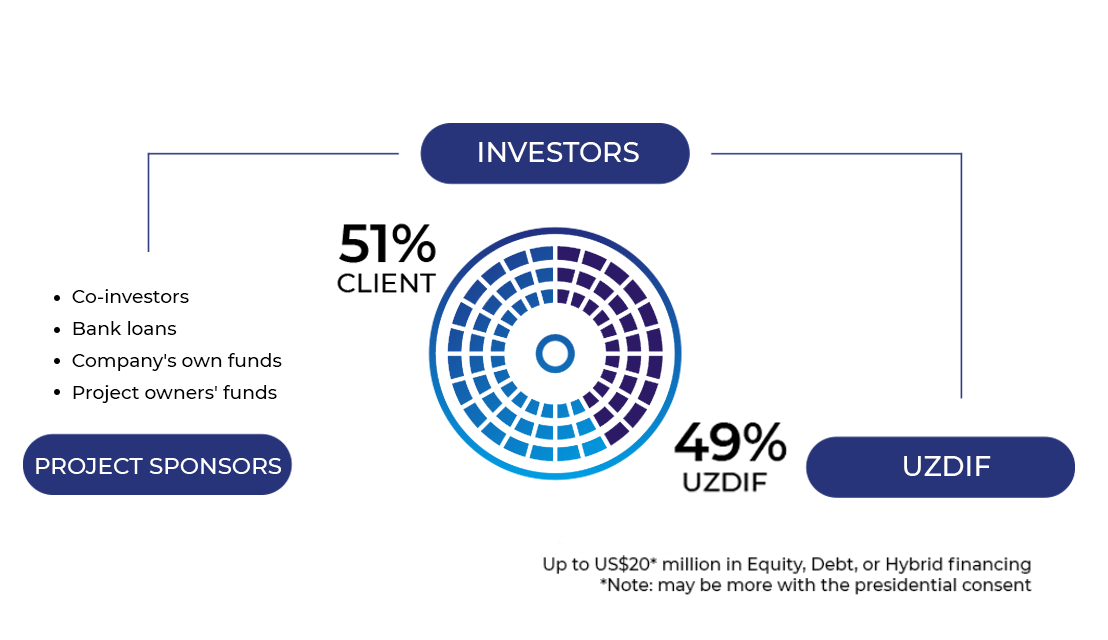

DEAL STRUCTURING

- Up to 49% of the total project cost in the form of equity, debt or hybrid financing.

- UzDIF can act as a lead investor with a consortium of investors if their combined share is larger than UzDIF’s.

- UzDIF can structure financing through SPVs and other vehicles in foreign jurisdictions for investors' comfort.

- Ability to syndicate and leverage own investment with top names and IFIs.

- UzDIF’s due-diligence findings will be available for investors to facilitate decision-making.

LOCAL PRESENCE

- Your eyes, ears, hands, and feet on the ground

- Expertise from professionals with educational background from Western institutions and communication without any language barriers.

- Enlist UzDIF’s market knowledge, professional network and resources to your competitive advantage